Why It’s Essential to Talk About Money

Have you ever been to a party and a friend shares they make “really good” money? Or maybe you’re at brunch, and a family member says they need to “stay on a budget.” But if you were to ask for any details, then suddenly heads turn, eyes drop to the floor, and an uncomfortable silence fills the room. You’ve committed the social taboo of talking about money.

Avoiding a real conversation about money is all too common with about 44% of Americans seeing personal finance as the most challenging topic to discuss with others. This challenge isn’t only limited to our friendship circles but also our closest relationships. According to a Fidelity Investments survey, 43% of Americans don’t know how much their spouse makes.

Feeling money illiterate, combined with the social prohibition of talking about money, leads to the debilitating emotional sandwich of shame and embarrassment. That makes talking about money or seeking help very difficult. But, the fact is, not talking about money can be damaging and not just for your finances, but your health and happiness. That’s why we want to unpack some of the ways talking about money can help you, and how to start that challenging conversation.

How Talking About Money Can Help You and Your Finances

You can talk about money, and you should talk about money. It can be informative and might even result in positive actions like asking for a raise or saving money. Below are six ways talking about money can help your finances.

1. You Can Discover If You’re Being Paid Enough

Sharing your salary, wages, or rates and inquiring what others make is the first step to figure out if you’re being appropriately compensated. This transparency could help you, or someone else. Thankfully, talking about your income is becoming more common with efforts being made to close the wealth gap for both women and minorities. You can do your part by being open and honest about your income.

2. You Can Compare Budgets to Put Your Own In Perspective

Talking about money with your friends and family can help to put your budget in perspective. This is especially true if you’re looking for ways to cut expenses. Knowing what others spend on rent, groceries, etc., can help you make your own decisions about where you can save.

3. You Can Find New Ways to Effectively Manage Your Money

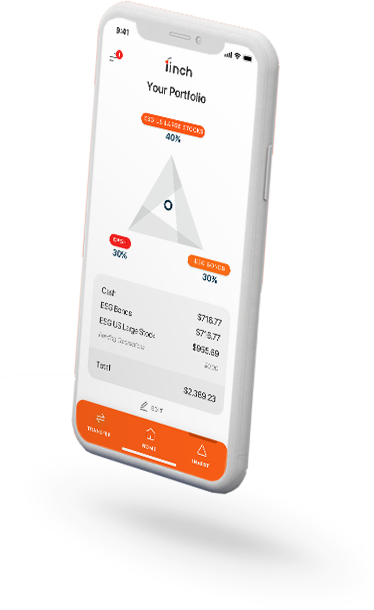

Your friend and family circle is also a great place to discuss money management tips and tricks. Ask about money management apps, savings tools, and where they keep their money. This type of money talk might help you find a new tool to manage your finances efficiently and effectively.

4. You Can Have A Financial Plan for the Worst-Case Scenario

Talking about the worst-case scenario might be even scarier than talking about your salary, but it needs to happen. You should talk with your partner, parents, and even grandparents about their general financial health, beneficiaries, and life insurance policy. This way, if someone was to pass away, the family isn’t clueless about the financial estate.

5. You Can Build Generational Wealth

Talking about money and teaching your children about money can be your legacy. By modeling healthy money conversations for your children, you help build financial literacy and the foundation for generational wealth.

6. You Can Protect Your Money

Scams and shady financial products are all too common these days. If you are talking about money regularly, you’re more likely to be aware of the predators and be able to take steps to protect your hard-earned cash.

Simple Ways to Start the Money Conversation

As you can see, talking about money is crucial for change and financial growth. Here are some simple ways you can get started today.

Prepare for Money Conversations

You do not need to know everything about finance to start talking about money. Instead, you can take it slow and spend a little time preparing for the money conversation with your friend, family, or partner by educating yourself. Read a personal finance blog, listen to a money podcast, or buy a personal finance book like Broke Millennial: Stop Scraping by and Get Your Financial Life Together by Erin Lowry.

Make Looking At Your Finances A Consistent Practice

You must commit to regularly looking at your finances. This could look like a weekly date to discuss your budget or a monthly review of your bank and credit card statements. It’s hard to talk about money if you don’t have the full picture of what is coming in and out, which is why this is an essential step in having money conversations. If you have a partner, be sure to do this together.

Frame Questions In A Way That Isn’t Shaming

When you do review your finances or discuss money with anyone, keep the questions judgment-free. This means you want to avoid saying something like, ‘Do you really need to buy that?’ Instead, frame questions as hypotheticals like ‘What if we used that money for this instead?’.

Create Goals and Hold Each Other Accountable

It’s important to create financial goals, so you have a purpose for your money. This could be paying off debt, saving for a trip, or learning to invest. When you create your goals, share them with a friend, and hold each other accountable with check-ins. Don’t forget to celebrate the little victories along the way.

It’s Important to Know Your Financial Past

In any money conversation, each person is going to have a different financial past. How your family handled money will likely impact your current views. This would be a great financial conversation to have so you can better understand a person and get to know the many varied financial perspectives around you. You can try starting with this question: “How important was money to you when you were growing up?”

It’s Ok to Disagree

Personal finance is personal. That means you and your friends might have different money philosophies, and that’s ok. You can still talk about money even if you disagree about where to keep your savings or how to spend your income. The point is that you’re breaking the silence and establishing a safe space to learn and grow on your financial journey.

The Value of Honest Money Conversations

Money conversations can and will be hard. You will need to overcome fears and anxiety, but this will all be worth it once you discover the value of honest money conversations. Talking about money can help you increase your financial awareness, solve financial problems, connect with others on a deep level, and ease financial stress. Start a money conversation today; your financial well-being is worth it.