How Much Should I Save for a Comfortable Retirement?

You know you need money for the day you decide to stop working, but how much should you save for your golden years? Unfortunately, we can’t give you a singular number, but we can give you the tools to calculate your own retirement goals and get you on track to investing for your future.

How to Calculate Your Retirement Number

To calculate how much you need to retire, you will first want to consider how much money you will need to live a happy life after you have stopped working. How often you need to access your retirement savings, or your withdrawal strategy, is an important consideration. Withdrawal strategies help you define how much and how often you plan to take money out of your retirement accounts once you leave work.

While there are many strategies, the most general withdrawal strategy is the 4% rule – also known as the 25x rule (if you multiply 4% by 25 you get 100%).

The 4% Rule: Annual Retirement Income x 25 = Retirement Savings Goal

You can use this rule of thumb to calculate how much you need to save for retirement.

Example:

Let’s assume that Vicky W. will need an annual retirement income of $78,000.

$78,000 x 25 = $1,950,000

Vicky W. would need to save a little less than $2 million for retirement.

Before you panic at how large your retirement savings number may be, remember that investing in the market provides returns over the long run, meaning your money can grow. Also, note that you may not need to save all of that money before you retire because your investments will still be generating returns during your retirement years. You only withdraw 4% a year and the rest is left to grow.

Lastly, keep in mind this calculation is a general rule of thumb, but your financial planner or financial advisor may suggest a more conservative strategy. This would mean that your retirement savings goal would increase.

How to Determine Your Annual Retirement Income

A key component of the formula above is estimating your annual retirement income. This is where it can get a little tricky because you need to decide how much you want to live off each year in retirement.

To find this number, you will need to consider:

- Where you plan to live

- If you will still have dependents

- If you will have outstanding debt

- What you want to do when you’re retired

Each of these elements will affect how much you will need to withdraw from your retirement each year.

A Rule of Thumb for Determining Your Annual Retirement Income

First, remember that your annual retirement income will be an estimated number at this point.

If you need a starting place, financial advisors often recommend planning to save at least 80% of your pre-retirement annual income. For example, assuming that your pre-retirement annual income was $50,000, 80% of $50,000 would be an annual retirement income of $40,000. However, if you plan to travel more when you retire or move to a higher cost of living area, this means your annual expenses will increase and you should plan for this in the amount of annual income you need.

Once you estimate your annual retirement income, you can plug this into the formula above just like we did for Vicky W. to find how much you need to save for retirement. Let’s look at one more example using the annual retirement income of $40,000.

$40,000 x 25 = $1 million

In summary, you should estimate your annual retirement income and then multiply that by 25 to find your retirement savings number. That is just the start and you may decide to increase that number in the future as your plans change. Now, let’s give you some tools to start saving for retirement today.

5 Easy Ways to Start Saving for Retirement

Now that you can see your retirement savings number is going to be hefty, it is time to start building your nest egg.

1. Get Your Company Match

If your company offers a 401(k) it is likely that they also offer a company match. For example, your company may offer to contribute 5% of your annual salary if you contribute 5% as well. If you’re not sure about a company match, but you do contribute to a 401(k) plan, then talk to your Human Resources department.

2. Open an IRA or Roth IRA

An IRA is an Individual Retirement Account and can be opened independent of your company. An IRA is a pre-tax account, meaning you only pay income taxes when that money is taken out in retirement. In contrast, when you contribute to a Roth IRA, you pay taxes now, and then you can withdraw from this account tax-free when you retire.

3. Open an HSA

A third way you can fund your retirement is through a Health Savings Account or HSA. An HSA has tax benefits now as you can use the funds for medical expenses tax-free. If you leave them alone, you can also withdraw from the account for any purpose after the age of 65.

4. Automate Your Retirement Contributions Every Month

The key to building your nest egg is consistent savings over a long period. This is why it is helpful to automate your retirement contributions each month. The money will come out of your paycheck or checking account without having to do anything.

5. Choose Your Investments

Opening an account is only the first step. You want to make sure that the money you send to those retirement accounts each month is being invested as this is not always automatically done for you. Common investment choices include mutual funds and ETFs as these are easy ways to diversify your investments.

Important Considerations When You’re Saving for Retirement

Retirement planning is an active process and there are a few considerations when you are in the pre-retirement saving phase.

- At what age do you plan to retire? This will inform you how much you need to save right now to reach your retirement goals.

- What is your current risk tolerance? This will determine your portfolio mix.

- Will you be collecting social security? This can also affect how much you need to save.

- Are you vested in an account? This will influence your decision to change jobs or leave a company retirement plan.

If any of these are confusing, set up a meeting with your financial planner or financial advisor to discuss your retirement plan.

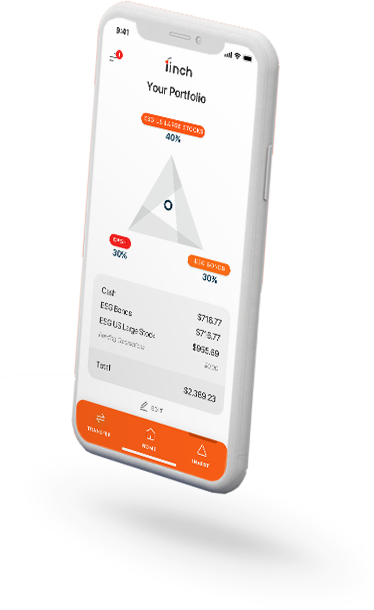

Your largest life expense will be funding your retirement. The sooner you start the better. Let Finch be a part of your plan to build your wealth, with our all in one account so that your every penny is working for your future.